How to Short Bitcoin on the Market: A Comprehensive Guide

Short selling Bitcoin can be an effective strategy for traders looking to profit from the cryptocurrency’s price declines. In this guide, we will delve into the necessary steps and strategies needed to short Bitcoin successfully. If you’re willing to ride the volatility of the crypto market, you might even take advantage of promotions like the how to short bitcoin on primexbt PrimeXBT no deposit bonus to enhance your trading experience.

Understanding the Basics of Short Selling

Short selling, often referred to as “shorting,” involves selling an asset that you do not own, with the intention of buying it back later at a lower price. The basic concept relies on the expectation that the price of the underlying asset will decline. In the case of Bitcoin, the fundamentals of shorting remain consistent regardless of market cycles.

How It Works

Here is a simplified breakdown of how short selling works:

- You borrow Bitcoin from a brokerage or an exchange.

- You sell the borrowed Bitcoin at the current market price.

- You wait for the price to decline.

- Once the price has dropped, you buy back the same amount of Bitcoin at this lower price.

- You return the borrowed Bitcoin to the brokerage and keep the difference as profit.

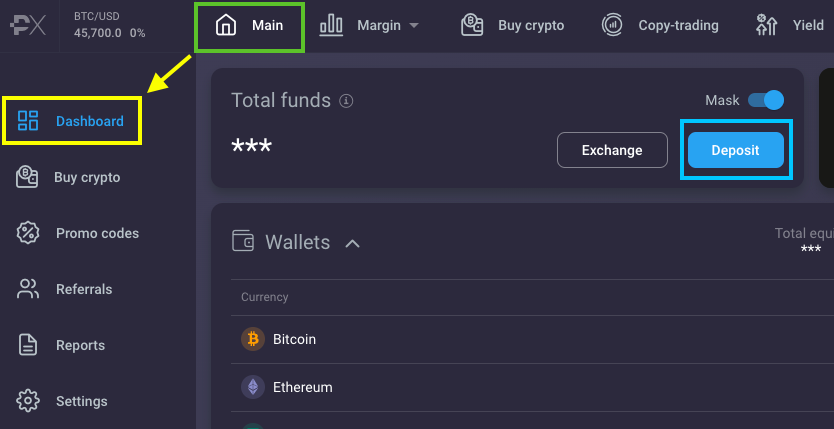

Choosing a Platform to Short Bitcoin

Various platforms cater to traders interested in shorting Bitcoin. Each option comes with its unique features and benefits, making it essential to choose one that aligns with your trading style. Below, we outline some common platforms:

1. Cryptocurrency Exchanges

Major exchanges such as Binance and Kraken allow traders even to short Bitcoin directly from their platforms. They often provide various tools and features designed to facilitate margin trading, enabling users to borrow assets more efficiently.

2. Derivative Platforms

Derivative platforms such as BitMEX and Bybit offer contracts like perpetual futures, which significantly amplify leverage and risk. These platforms enable users to take larger positions than they might otherwise afford, drastically increasing potential profits or losses.

3. Forex Brokers

Some traditional forex brokers have begun offering cryptocurrencies. These brokers may offer different ways to short Bitcoin, enabling users to trade cryptocurrencies similarly to how they might trade fiat currencies.

Strategies for Shorting Bitcoin

To short Bitcoin effectively, consider implementing these strategies:

1. Technical Analysis

Utilizing technical analysis can provide insights into potential price movements. Traders often use chart patterns, moving averages, volume indicators, and other tools to identify points where the price may reverse.

2. News and Sentiment Analysis

Keeping an eye on news events can aid in predicting fluctuations in Bitcoin’s price. Regulatory announcements, technological advancements, or economic indicators can heavily impact market sentiment and, consequently, Bitcoin’s price.

3. Risk Management

Short selling can be risky, so implementing solid risk management strategies is essential. Set stop-loss orders at predefined levels to minimize your potential losses. This method ensures you have a plan in place should the market not behave as expected.

The Risks of Short Selling Bitcoin

As lucrative as shorting Bitcoin can be, there are several risks involved:

- Unlimited Loss Potential: Unlike going long on an asset, where the most you can lose is your initial investment, shorting has no cap on potential losses. If the price of Bitcoin rises instead of dropping, losses can be substantial.

- Market Volatility: Cryptocurrencies are notoriously volatile. Sudden price spikes can trigger margin calls and force you to close your position at a loss.

- Short Squeeze: A situation may arise in the market where many traders are short on Bitcoin. If the price begins to rise, a rush of buying can occur (a «short squeeze»), leading to even higher prices and heightened losses.

Conclusion

Shorting Bitcoin can provide significant trading opportunities when approached with caution and a solid understanding of the market. To maximize your strategies, ensure you are equipped with the right knowledge, utilize various tools and platforms, and remain vigilant regarding market trends and risks. With the right approach, traders can capitalize on Bitcoin’s price movements, strategically navigating the exciting and sometimes turbulent world of cryptocurrency trading.